|

The U.S. homeownership rate recently hit a 20-year low, following a steep decline from peak levels in 2004. This shift in ownership yields no small boost for the rental market: Data shows household formation increased by 1.66 million year over year, with 2 million more renter households and 350,000 fewer owner households. Cue the celebratory cheering of happy landlords all across the country.

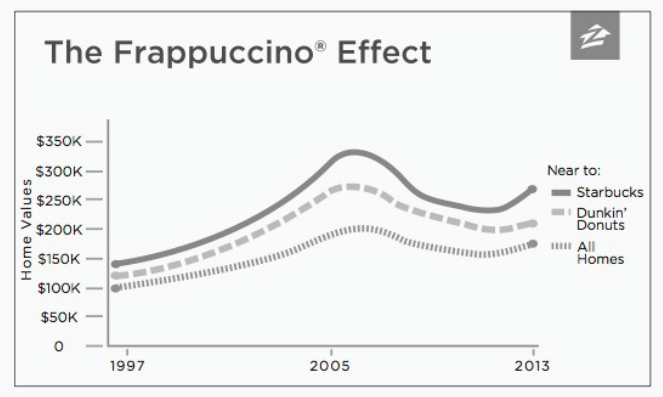

Coffee and donuts have more in common with real estate than you might think. Living near a Starbucks not only increases your PSL consumption (that's Pumpkin Spice Latte, for the uninitiated), but may also be linked to stronger gains in nearby home values. This so-called "Starbucks Effect" correlated with a 96% gain in value between 1997 and 2013 for homes in close proximity to a retail Starbucks location. While this growth rate clearly outstrips the broader market, it appears the Starbucks morning roast also has a leg up on its peers: the suitably named "Dunkin' Donuts Effect", correlated with an increase of only 80% over the same time period, suggesting American housing prices may not run quite so well on Dunkin’ after all.

What a shame, I was really rooting for those glazed donuts. Now that we are a couple weeks into the new year, let's quickly reflect on 2014 and take comfort in knowing how (in)accurate many of the economic forecasts actually were. While most economists were correct in predicting the strength of our rental market, they were completely blindsided by the nation's falling interest rates, growing stock market, decreasing jobless rate, disappointing home sales, and plummeting oil prices. Oops.

In their defense, economic projections are difficult to make as they are based on complex algorithms, potentially bad or incomplete data, and most importantly, the economist's ability to master the delicate art of praying and finger-crossing. Keeping their imperfect methods of future-telling in mind, I present to you the housing forecast of 2015 in the next post, as told to me by various real estate experts. Stay tuned! Rent prices will go up. If you're a renter living without that proverbial security blanket called rent control, I come bearing bad news: rents, which are currently rising at a 7-year high, will continue to rise faster than home values. As renters continue to pour more and more cash into the dark abyss of indefinite monthly payments, economists expect that a fixed mortgage payment, a more stable housing market, and future equity may be enough to entice otherwise content renters to rethink their options and enter the housing market.

Home appreciation rates will decelerate. Just as we saw last year, the growth of home prices will continue to slow dramatically. Sellers will not have as much of the upper hand as they once did before, creating a more balanced housing market that more buyers can participate in. Mortgage rates will increase. For years, economists have been saying mortgage rates will rise. And in those same years, we've been seeing consistently low rates. BUT, this year could be the year they finally get it right. Since keeping interest rates low after the financial meltdown, the Fed has indicated a coming change. Mortgage rates are expected to modestly increase in the summer, up to 5% by year's end. The next generation of homebuyers. Experts predict that specifically the millennial demographic (18-35 years old) will soon stop renting and start buying. Their home-buying activity has been lackluster thus far, putting the share of first-time home buyer sales at a 27-year low. It's not that millennials are uninterested in homeownership, as many critics would accuse them of. It's that many of them have been waist-deep in student loans, feeling the longer-term effects of the recession in terms of employment and income, and much slower to get married and have children than earlier generations. But as maturity settles in and makes them settle down, along with the help of the low down-payment programs introduced in December (3% down!), they're expected to take over the title from the GenX cohort (35-50 years old) as the largest group of homebuyers this year. So there you have it - our 2015 housing forecast in a nutshell. I'll check back with you in a year to confirm how right (or wrong) these projections actually are. |

Michaela ToAll things real estate. Categories

All

Archives

April 2022

|