|

Finally some good news for the discouraged and disgruntled Bay Area buyers! Zillow's latest numbers show that the nation's housing market is actually starting to level off. While the Bay Area is still one of the hottest markets in the nation, we're seeing a decline in home appreciation growth and the market returning to normal.

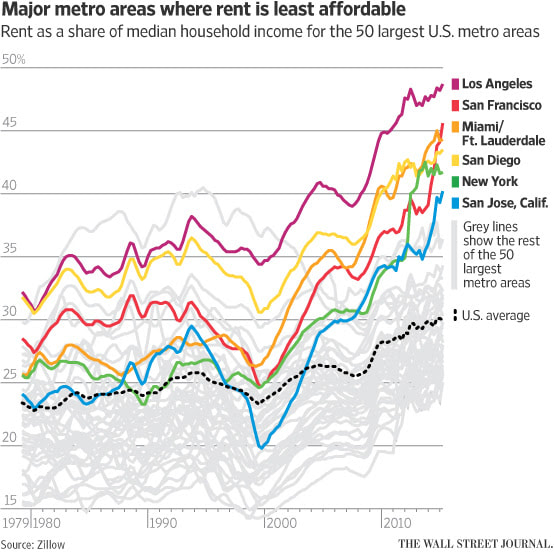

Falling home valuations and increased home inventory are expected to spur renters to buy, especially given the dramatic increases in rents. SF area rents jumped over 14% to $3,285, proving to be painful - both financially and physically - as tenants go as far as to skip their dentist and doctor visits just to pay their landlords. Because what good is a healthy body if there is no roof to shelter it? The first world problems of the middle class are real! And of course I cannot end this post without a shameless plug: Take advantage of the slowing market and find your next home here! The rent-to-income ratio is the highest EVER (or at least since 1979, because Zillow only has data from that far back). Renters on a national average can expect to pay 30.2% of their income on rent, while renters in the San Francisco metro area pay a whopping 47% of their incomes on rent (only trailing behind LA).

Thanks to the perfect combination of increased demand and limited supply as income levels stay relatively flat, the outrageous proportion of incomes spent on rent will continue to rise as rent increases too. These unaffordable rents are making it hard for people to save for a downpayment, retirement, and even basic expenses like food and healthcare. Bad news: Rent is still as unaffordable as ever.

Good news (for buyers): The housing market is finally starting to slow down. Isn't real estate so much pun? |

Michaela ToAll things real estate. Categories

All

Archives

April 2022

|