|

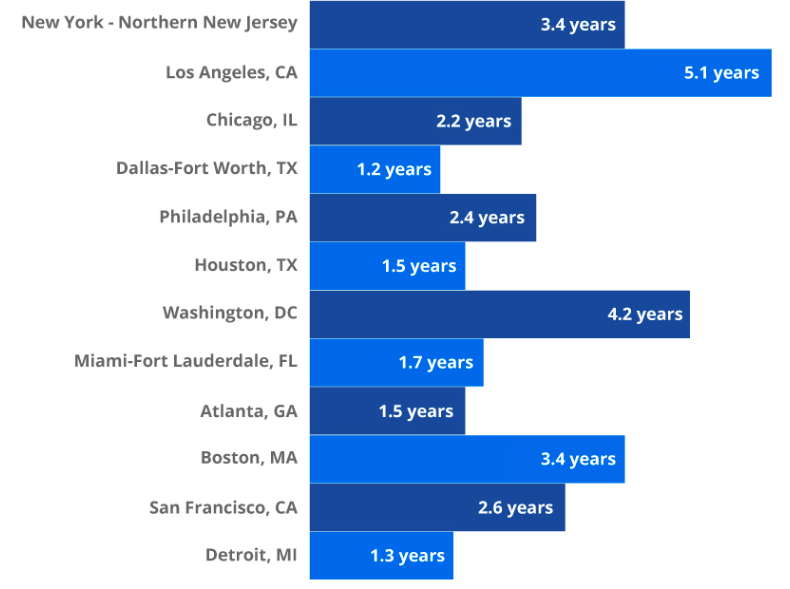

Buying makes more sense than renting if you plan on sticking around for a few years. Zillow's Breakeven Horizon Report found that homebuyers in the Bay Area would be paying less per month to own a home than to rent after only 2.6 years.

Zillow's calculation incorporated the costs associated with buying and renting, including upfront payments, closing costs, anticipated monthly rent and mortgage payments, insurance, taxes, maintenance and potential renovation costs. Here's how our breakeven horizon points compare to the country's other major metro areas: The Bay Area is the second worst region in the country (trailing behind LA) to keep up with housing creation. This is surprising to approximately zero people, but isn't it reassuring to have more numbers confirming the sad truths we all already know? New analysis from Zillow shows that for every 1,000 new residents in the Bay Area, there were only 193 new housing units permitted, making it one of the country's least affordable housing markets. Residents can now expect to spend a whopping 44% of their income on rent, or 39.2% on a monthly mortgage payment.

Meanwhile, Zumper, a website that lists and analyzes rentals, released its March national rent report, which found that SF is still the most expensive city in the United States, although rents dropped by 1.7% to a median of $3,400. The migration from SF across the Bay Bridge, mostly caused by everyone's ambitious dreams to not be homeless, has continued to drive appreciation in the East Bay, pushing Oakland up to No. 4 on the list, with a median rent of $2,000. As the old saying goes: The struggle is real. |

Michaela ToAll things real estate. Categories

All

Archives

April 2022

|