|

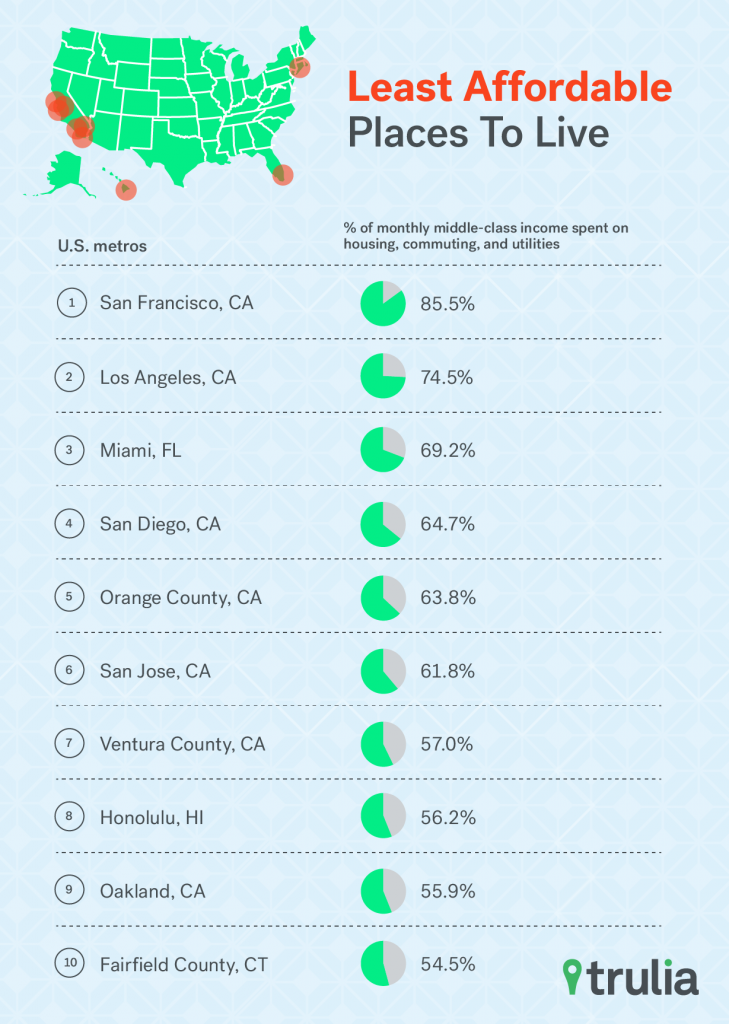

Tired of seeing the Bay Area on lists of "Least Affordable Places to Live" yet? Welp. That's too bad, because here's another one.

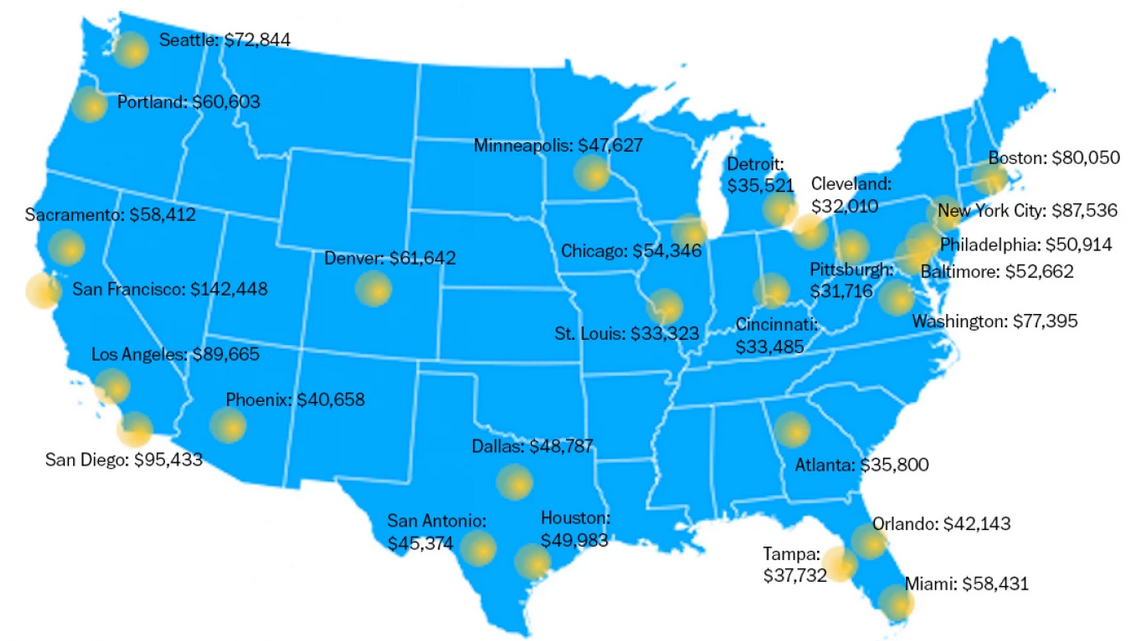

(Spoiler alert: SF, San Jose, and Oakland made it to the top 10.) New data from Trulia finds that the average-earning SF resident has to pay 77% of their monthly salary toward the average mortgage as of August 2015 (assuming 30-year loan, 4% interest rate, property taxes, and insurance). That's an insane 20% increase from just a year ago. Trulia factored in the costs of utilities and of commuting, which SF (and San Jose) has among the lowest costs for, so some of what homebuyers lose in affordability are made up by cheaper commuting and utility costs. Still, added all together, average mortgage, utilities, and commuting add up to 85.5% of the median income earner's wages. That leaves only 14.5% left over for everything that isn't housing yourself, getting to and from the office, and keeping the heat and lights on. In comparison to Oakland, where these expenses make up (only) 55.9% of a resident's income, it almost seems as if Oakland is an inexpensive place to live. But don't worry, Uber will be sure to change that soon. And the award for The Most Unaffordable Place To Live goes to...the Bay Area. You are shocked, I can tell. To buy a median-priced home of $742,900 in the Bay Area (which includes SF, San Mateo, Alameda and Contra Costa counties), all you need to make is a measly income of $142,448 a year. That's it!

On the opposite end of the spectrum, Cleveland is the most affordable metro area on the list, where you can buy a huge roof over your head with just a slightly lower salary of $32,010. But then....you'd have to be a Cavs fan. And who wants that? (See appropriately colored map below for the salary needed to live in other major metros around the country.) |

Michaela ToAll things real estate. Categories

All

Archives

April 2022

|