|

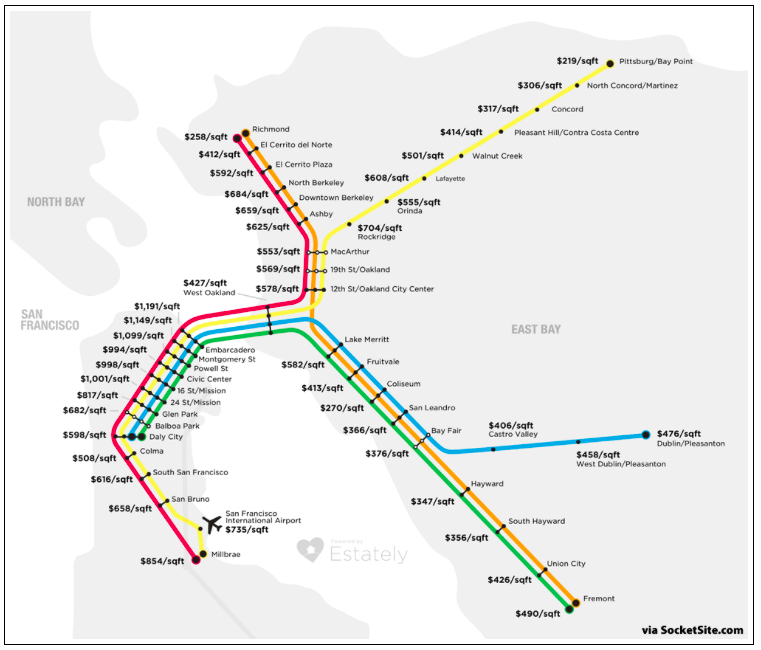

Inquiring minds want to know. To answer our burning questions, Estately mapped out the relative cost of living near BART, compiling the average sale price per square foot for all the houses, townhouses and condos that have sold within a one-mile radius of each BART station over the past six months.

(If squinting at the blurry numbers on the map is hurting your eyes too, click here for a larger view.) Here are the ten “most expensive stops” and relative commute times to Downtown San Francisco (defined as Embarcadero station): 1. Embarcadero – $1,191 per square foot (0 minutes) 2. Montgomery Street – $1,149 (2 min) 3. Powell Street – $1,099 (4 min) 4. 24th Street/Mission – $1,001 (9 min) 5. 16th Street/Mission – $998 (7 min) 6. Civic Center – $994 (6 min) 7. Millbrae – $854 (25 min) 8. Glen Park – $817 (11 min) 9. SFO – $735 (32 min) 10. Rockridge $704 (20 min) And the ten least expensive: 1. Pittsburg/Bay Point – $219 per square foot (62 minutes from Downtown San Francisco) 2. Richmond – $258 (35 min) 3. Coliseum – $270 (20 min) 4. North Concord/Martinez – $306 (56 min) 5. Concord – $317 (43 min) 6. Hayward – $347 (32 min) 7. South Hayward – $356 (36 min) 8. San Leandro – $366 (24 min) 9. Bay Fair – $376 (28 min) 10. Castro Valley – $406 (32 min) BART is also extending from Fremont into Silicon Valley, where new housing, commercial and retail developments are already being planned around the future South Bay BART stations. Home values nearby will probably increase, along with the number of commuters crammed into a sardine can of a BART train. (Twin Peaks, that is.)

Good news for buyers: the hottest housing market in the country might finally be cooling off. According to Redfin, home prices in San Francisco declined last month for the first time in four years. The median home price in the area dropped 1.8% in March from last year to $1.04 million. Quite a big difference from last year when prices in the market averaged 15% growth. Sales also took a hit, sinking 22% in March -- which normally marks the start of the busy home-buying season. While it's still a seller's market in San Francisco, homes are sitting on the market longer and inventory of unsold homes is at its highest in four years. Economists and housing experts credit the shifting real estate climate to Wall Street's recent volatility, overvalued tech companies, and slowing interest from overseas buyers. Oh, that's it? Apologies in advance for the buzzkill, but according to a new Charles Schwab survey, to be considered "wealthy" in the Bay Area, you need a net worth of at least $6 million. A net worth of $1 million is the baseline for being "comfortable." That's all, no big deal.

Charles Schwab surveyed 1,000 Bay Area residents aged 21 to 75 in Alameda, Contra Costa, Marin, SF, San Mateo, Santa Clara and Solano counties. The survey asked what residents considered enough money to be "wealthy" vs. "comfortable." They believed $2.5 million was the average needed to be wealthy in other parts of the country. The survey unsurprisingly found that locals are shocked by the cost of living here. 86% said the cost of living is "unreasonable" and 55% said living in the Bay Area makes it "difficult to reach their financial goals." To counteract these depressing stats, the majority also believe this is a prime place for career growth and innovation, and the Bay Area's economy is better than the national one. |

Michaela ToAll things real estate. Categories

All

Archives

April 2022

|