|

Developers have figured out how to spot early signs of gentrifying neighborhoods. While we often think gentrification is organically fueled by regular people (i.e. the artist, the boutique shop owner, the tech startup), much of the gentrification process is created by the irregular people too (i.e. the developers and financiers).

These deep-pocketed people are looking for a coffeehouse, a sandwich shop, enough different variety of retail establishments that it creates a key center of gravity for that community. The initial coffee shops signal to investors that the neighborhood is now open for business in a way that it wasn't before. As soon as developers detect these early signs of gentrification, they begin to empty their pockets into the neighborhood. As the Bay Area has seen, what tends to follow are the hipster bars, fancy pizza, and ridiculously overpriced ethnic food disguised as fusion something or other. Recently, in Harlem, real estate brokers even went as far as to band together to open coffee shops in areas where they were trying to sell or lease apartments, knowing that it would be a huge draw for hipsters and businessmen alike. The longer you wait to buy a home, the more it can cost you. A recent report published by Realtor.com indicates that the financial consequences of postponing or passing on a home purchase in the current market could be quite costly. It suggests that, on average nationally, the penalty of waiting to buy for one year is almost $19,000 and nearly $54,000 for a three-year delay. Meanwhile, the estimated wealth that a person would garner over 30 years of homeownership is over $217,000.

Current market conditions give buyers the opportunity to build substantial wealth in the long-term, compared with renters and later buyers. Affordability is at its peak now as both interest rates and price appreciation are on the inevitable rise, and buying a home enables a buyer to avoid high and escalating rents. So, don't be a snoozer/loser! But as a disclaimer: don't be irrational either. Hold off on the purchase if you don't expect to remain in the home long enough to cover the transaction costs of buying, selling, and market fluctuations. With all that said, find your next house here! Interest rates will rise as the economy bounces back. John Williams, president of the Federal Reserve Bank of San Francisco, says the Fed will likely raise interest rates later this year and continue to raise them gradually in the coming years. After a weak first quarter, he expects unemployment to go down and the economy to improve through the rest of the year.

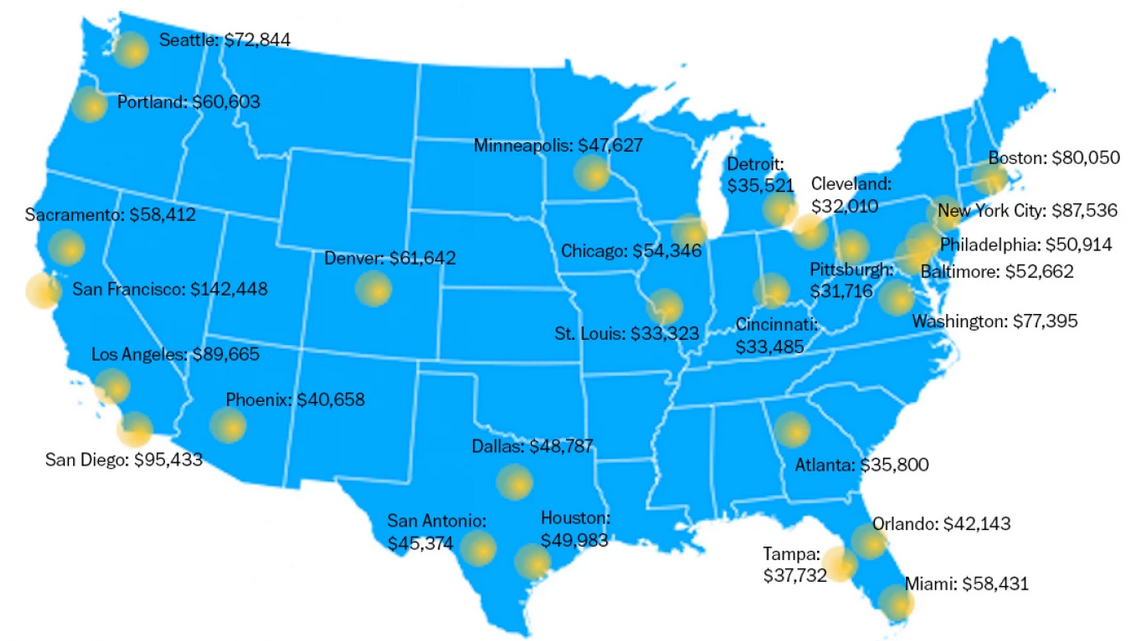

As a general rule of thumb, strong economic signals usually indicate future increased rates, and vice versa. So while interest rates remain low, it's the perfect time to consider that MVP lifestyle by snagging this Jack London Square penthouse that Stephen Curry used to live next to! (Curry with the spot??) And the award for The Most Unaffordable Place To Live goes to...the Bay Area. You are shocked, I can tell. To buy a median-priced home of $742,900 in the Bay Area (which includes SF, San Mateo, Alameda and Contra Costa counties), all you need to make is a measly income of $142,448 a year. That's it!

On the opposite end of the spectrum, Cleveland is the most affordable metro area on the list, where you can buy a huge roof over your head with just a slightly lower salary of $32,010. But then....you'd have to be a Cavs fan. And who wants that? (See appropriately colored map below for the salary needed to live in other major metros around the country.) |

Michaela ToAll things real estate. Categories

All

Archives

April 2022

|