|

If you've ever driven along the El Camino Real from San Francisco to San Jose, you’ve probably noticed the seemingly endless stretch of parking lots and strip malls that line the entire route. Well, get this—apparently there’s room for an estimated 250,000 new apartments along this road. Developers are trying to figure out how to make this happen as an attempt to alleviate the housing shortage.

Now let's be real, everyone loves a good strip mall. Where else can you do your grocery shopping, get a haircut, and pick up a burrito for lunch all in the same afternoon? So the goal here wouldn’t be to tear down every strip mall completely. Instead they suggest creating mixed-use buildings that would keep retail space on the ground level while adding apartments on top. California reportedly needs to build millions of new housing units to meet current demand. Governor Newsom pledged to build 3.5 million homes by 2025, but so far only around 100,000 homes are being built each year. Strip mall development might be a solid solution. Despite the rising home prices, SF's commercial real estate market may be foretelling a slowdown in the city's heated tech-driven economy. Recently there has been very little room to rent for companies in SF. Supply is tight enough that office rents here have even topped Manhattan’s to become the nation’s most expensive.

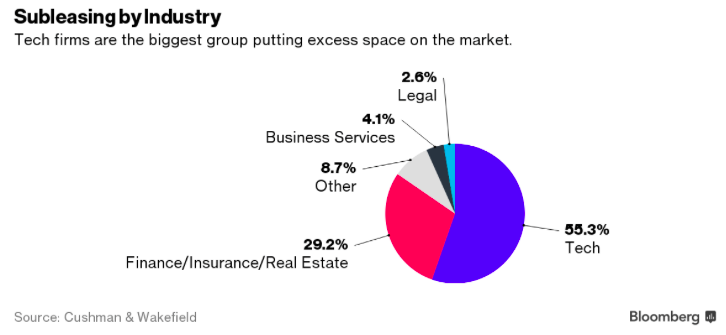

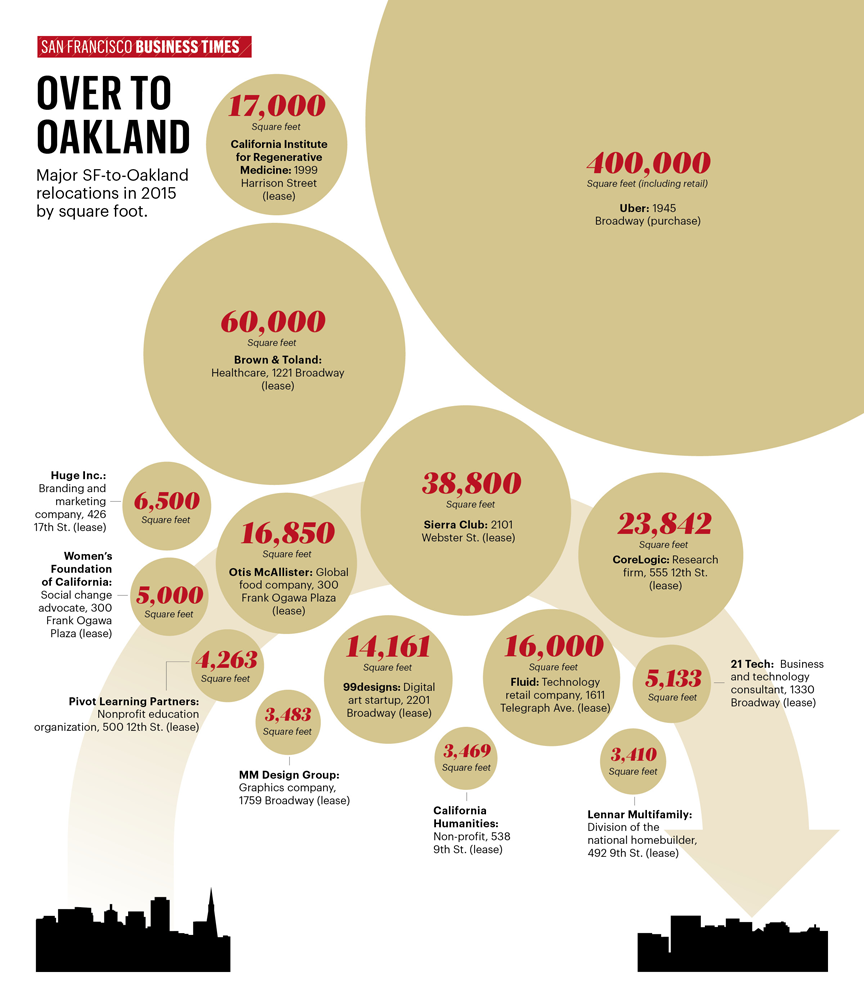

Office subleasing, an early indicator of past downturns, is at the highest level since 2010. Twitter, Intuit, and Zenefits are among the tech companies putting excess space on the market, showing signs that they are slowly but surely shrinking in size with no plans to expand anytime soon. Speaking of shrinking startups, a report came out yesterday that shows Fidelity recently slashed down the valuation of some big startups that have delayed going public (i.e. Dropbox, Cloudera, and Zenefits). Signs of a correction in the SF job market may translate to a correction in the housing market too. Quoted directly from SF Business Times (because I could never be so eloquent): "As the exodus from the pricey San Francisco office rents has pushed businesses to search for more affordable digs, one city in particular has reaped the benefits: Oakland.

Whether it's Uber buying the 400,000 square foot Uptown Station property, formerly the Sears building, or San Francisco bastion the Sierra Club pulling its 124-year-old stakes, more than a dozen major businesses have fled to Oakland so far this year." See chart below. Uber plans to open a global headquarter in Oakland by 2017, taking over the iconic Sears building in the middle of Uptown Oakland. After they finish a $40 million renovation, the newly named Uptown Station will be ready for 3,000 employees to occupy six floors. It will include an upscale food hall on the ground floor, a central atrium to allow natural light in the office space, and a basic necessity for every office: a rooftop with picnic tables and fire pits.

If Uber fills the Sears building completely, it will become Oakland's largest employer (that isn't a government agency or medical center) and likely to prompt the construction of luxury apartments and other housing projects around the area. That's code for: your rent will go up. A lot. |

Michaela ToAll things real estate. Categories

All

Archives

April 2022

|