|

Uber plans to open a global headquarter in Oakland by 2017, taking over the iconic Sears building in the middle of Uptown Oakland. After they finish a $40 million renovation, the newly named Uptown Station will be ready for 3,000 employees to occupy six floors. It will include an upscale food hall on the ground floor, a central atrium to allow natural light in the office space, and a basic necessity for every office: a rooftop with picnic tables and fire pits.

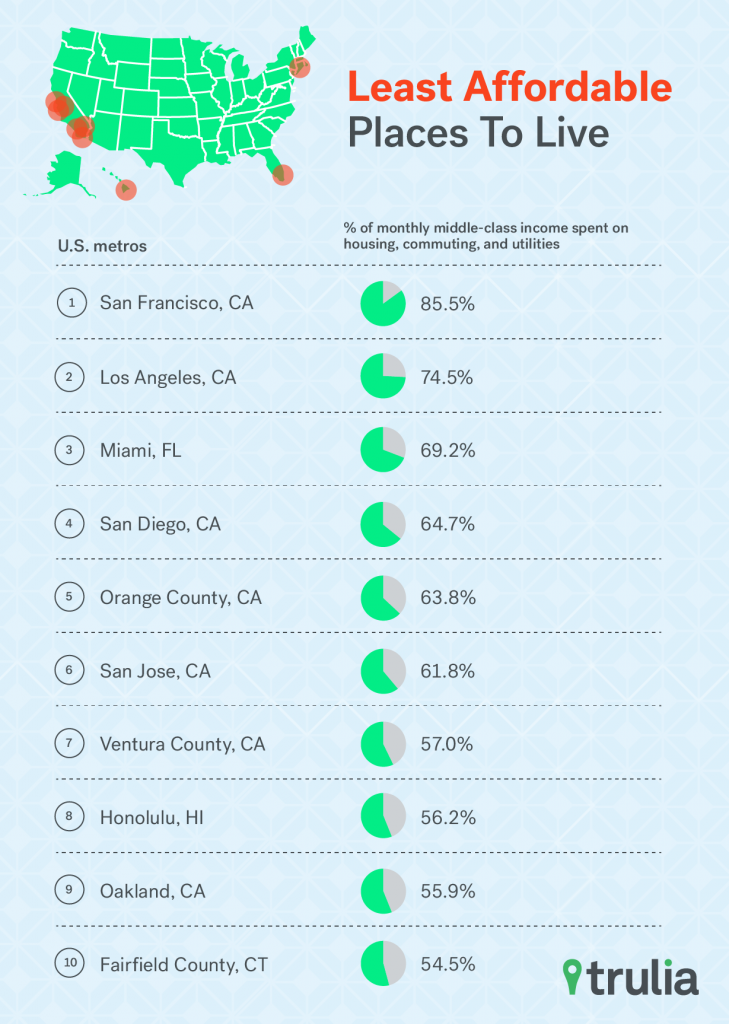

If Uber fills the Sears building completely, it will become Oakland's largest employer (that isn't a government agency or medical center) and likely to prompt the construction of luxury apartments and other housing projects around the area. That's code for: your rent will go up. A lot. Tired of seeing the Bay Area on lists of "Least Affordable Places to Live" yet? Welp. That's too bad, because here's another one.

(Spoiler alert: SF, San Jose, and Oakland made it to the top 10.) New data from Trulia finds that the average-earning SF resident has to pay 77% of their monthly salary toward the average mortgage as of August 2015 (assuming 30-year loan, 4% interest rate, property taxes, and insurance). That's an insane 20% increase from just a year ago. Trulia factored in the costs of utilities and of commuting, which SF (and San Jose) has among the lowest costs for, so some of what homebuyers lose in affordability are made up by cheaper commuting and utility costs. Still, added all together, average mortgage, utilities, and commuting add up to 85.5% of the median income earner's wages. That leaves only 14.5% left over for everything that isn't housing yourself, getting to and from the office, and keeping the heat and lights on. In comparison to Oakland, where these expenses make up (only) 55.9% of a resident's income, it almost seems as if Oakland is an inexpensive place to live. But don't worry, Uber will be sure to change that soon. |

Michaela ToAll things real estate. Categories

All

Archives

April 2022

|